Coinbase and PNC to work together as crypto reaches for Main Street

- - - Coinbase and PNC to work together as crypto reaches for Main Street

David HollerithJuly 22, 2025 at 11:00 PM

The largest US cryptocurrency exchange and a Pittsburgh regional lender announced a strategic partnership Tuesday that shows how upstart crypto and old-school banking are coming closer together.

The new arrangement between Coinbase Global (COIN) and PNC Financial Services Group (PNC) will give retail and institutional customers of the seventh-largest US bank a way to buy, sell and hold cryptocurrencies through their PNC accounts.

PNC will also begin providing Coinbase with select banking services, including settlement, as part of the agreement.

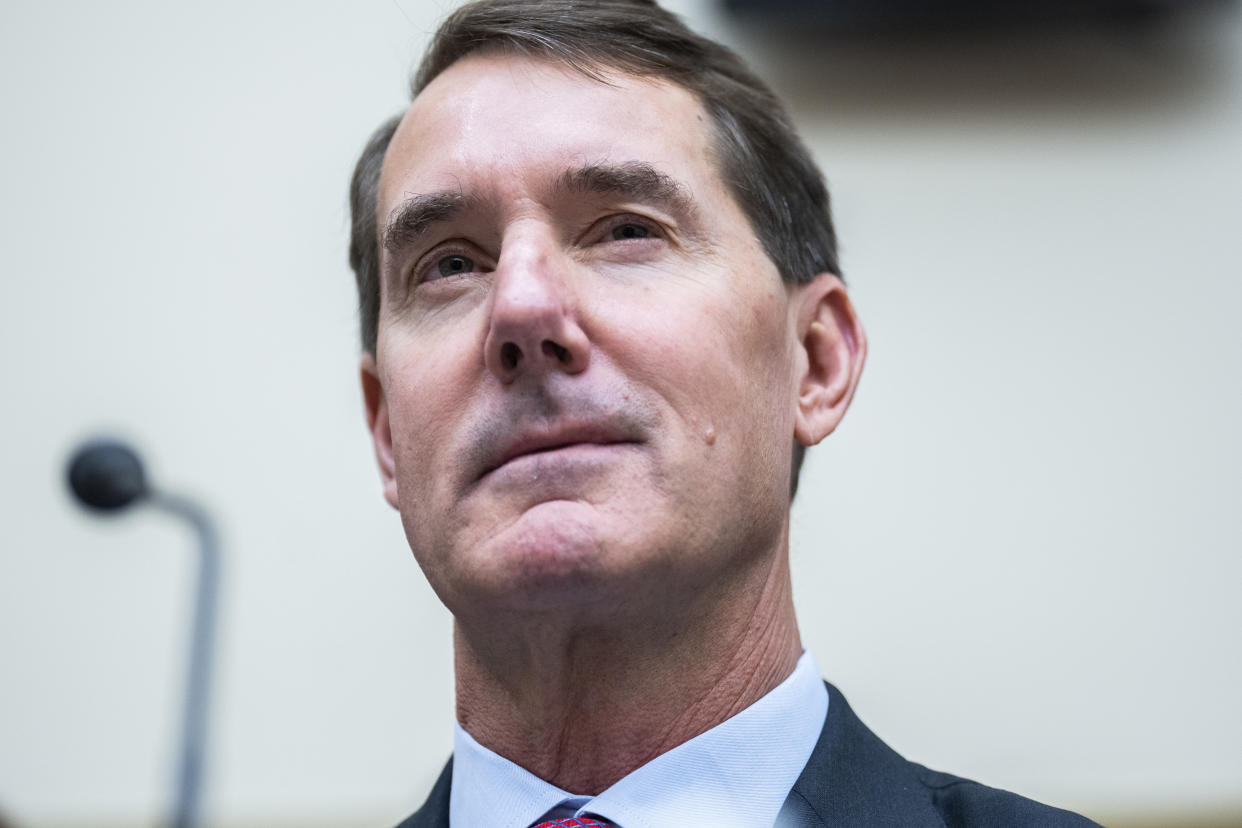

“Partnering with Coinbase accelerates our ability to bring innovative, crypto financial solutions to our clients,” PNC CEO William Demchak said in a statement.

"This collaboration enables us to meet growing demand for secure and streamlined access to digital assets on PNC’s trusted platforms,” Demchak added.

William Demchak, CEO of PNC Financial Services Group, in 2022. (Tom Williams/CQ-Roll Call, Inc via Getty Images) (Tom Williams via Getty Images)

The two companies described the relationship as in its early stages and said they plan to launch PNC’s first crypto offering in the coming months through the deployment of Coinbase’s newer crypto-as-a-service (CaaS) infrastructure product.

“PNC is a market leader in delivering best-in-class products for their clients," Brett Tejpaul, Coinbase’s head of institutional division, said in a statement. "We’re thrilled to support their entry into the digital asset market."

Such a partnership is an example of how the once segregated worlds of crypto and traditional banking have moved closer together this year as digital assets gain more favorable regulatory treatment from President Trump and lawmakers in Washington, D.C.

While Biden-era regulators discouraged banks from moving toward crypto after a series of blowups in the world of digital assets in 2022, the Trump administration has pushed to lower barriers between the two industries.

And the path toward clearer and more favorable rules for crypto in the US has in turn spurred investors to flock to digital assets.

Crypto’s total market capitalization is now nearing $4 trillion, up by $680 billion since the start of 2025, according to CoinMarketCap. Meanwhile, the price of bitcoin (BTC-USD), the largest cryptocurrency, notched fresh all-time highs above $122,000 earlier this month.

The logo for Coinbase Global Inc, the biggest U.S. cryptocurrency exchange, is displayed on the Nasdaq MarketSite jumbotron and others at Times Square. REUTERS/Shannon Stapleton/File Photo (Reuters / Reuters)

Some crypto firms are seeking approvals for national trust bank charters as they push for more customers, spurring some pushback from bank lobbyists.

The American Bankers Association and Independent Community Bankers of America have asked the Office of the Comptroller of the Currency (OCC) to delay consideration of these charters to be sure the crypto firms aren't planning to use them for other banking services outside the scope of what the charters allow.

At the same time, big US banks are assessing their options for whether to buy, build, or partner with crypto firms to get a piece of the digital asset business.

At least two big Wall Street institutions — Morgan Stanley (MS) and Charles Schwab (SCHW) — have already signaled plans to offer cryptocurrencies through their wealth management platforms in the coming months.

JPMorgan Chase (JPM) is exploring letting customers lend against their crypto-related products as soon as this quarter, according to people familiar with the matter. The Financial Times reported Tuesday that the bank is also exploring extending such an offering to let clients lend directly against their crypto holdings next year.

JPMorgan CEO Jamie Dimon, Citigroup (C) CEO Jane Fraser and Bank of America (BAC) CEO Brian Moynihan all said last week they are planning to get involved in dollar-pegged stablecoins as Congress passed the first-ever federal framework for those digital assets. Trump signed the legislation into law on Friday.

Big banks have also convened to explore prospects for launching a collaborative stablecoin network similar to Zelle, and PNC's Demchak has been at the center of those collaborative discussions.

'Brilliantly boring'

PNC's new partnership with Coinbase is another demonstration of how crypto is reaching for even wider adoption.

The Pittsburgh-based bank has roots that trace back to the Civil War, and it prides itself on its conservative principles. A national ad campaign that rolled out last year positioned it as a “boring” lender that helps customers and businesses build wealth without taking giant risks.

The logo of PNC Bank on the window of a branch in Washington. REUTERS/Ashraf Fahim (REUTERS / Reuters)

“Brilliantly Boring since 1865,” one slogan read.

Emma Loftus, PNC’s head of treasury management, said in an interview with Yahoo Finance that the partnership with Coinbase is "absolutely on brand for us."

"It's not about a lot of trading and volatility," Loftus said. "It's all about how do we support our clients who actually want to be able to participate in these markets?"

In retail and wealth customer accounts, PNC has seen funds flow into crypto-related activities offered by other providers, and there is real interest in being able to give customers a better connection and visualization of these activities through their PNC bank accounts, Loftus added.

“Now we are allowed to bank people in that business,” Demchak said when asked by an analyst in an earnings call last Wednesday about stablecoins, crypto, and the new legislation in Washington.

“Just given our raw capabilities, you would expect that we'll get some meaningful clients there. Secondly, we will enable our clients in the very near term to be able to use crypto,” Demchak added.

David Hollerith is a senior reporter for Yahoo Finance covering banking, crypto, and other areas in finance. His email is david dot [email protected].

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance

Source: “AOL AOL Money”